- #Entering personal expenses in quickbooks how to#

- #Entering personal expenses in quickbooks professional#

- #Entering personal expenses in quickbooks download#

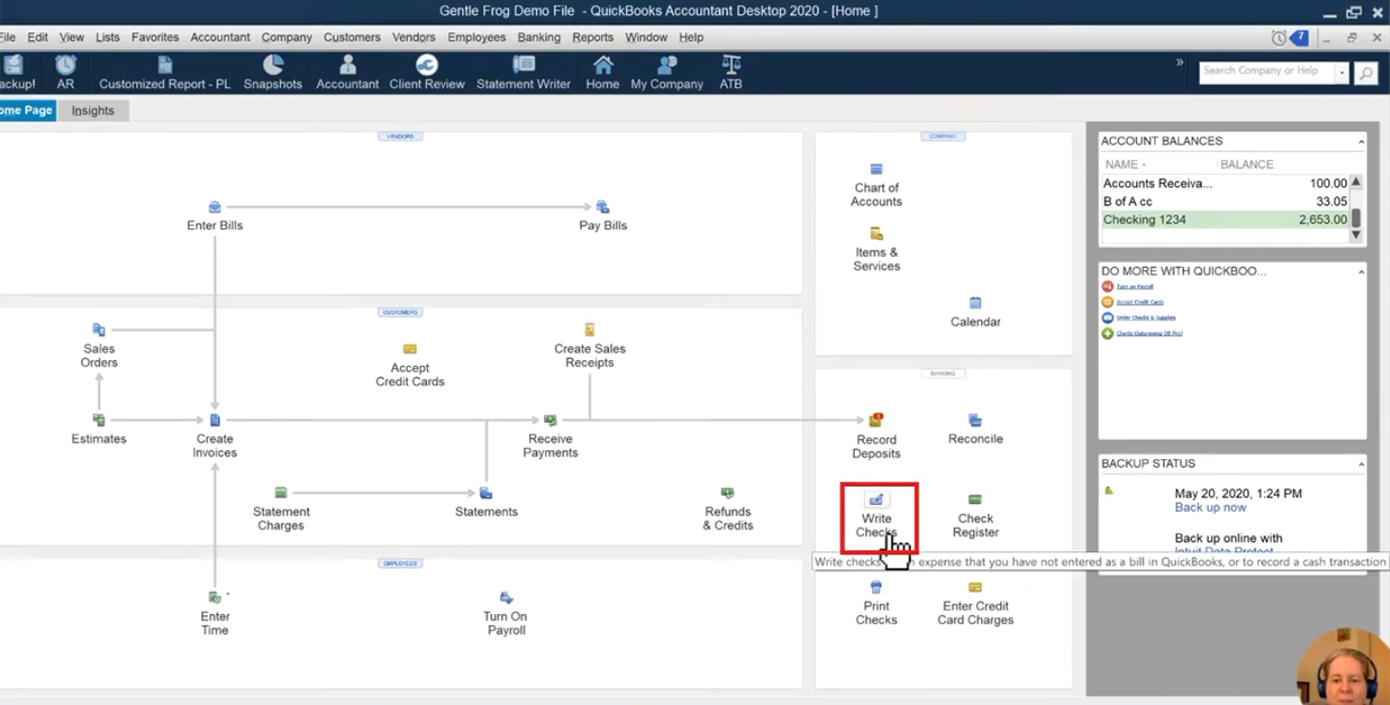

This is an ideal situation for Kim to use QuickBooks’ Expenses tab, since payment occurs at the same moment as the sale. Kim’s trinket purchase is a business expense. On June 1 st she sells a trinket to Kim, which Kim pays for in the store with a debit card. In general, you use the Expenses tab (available on the window that QuickBooks displays when you choose the Banking menu’s Write Checks command) when the moment you incur the expense and the moment you pay the expense are the same-or in the same accounting period.Įxample: Mary owns a small retail shop.

When to Use the Expense Tab of the Write Checks Window This is an ideal situation for Biff to use QuickBooks’ Enter Bills feature, since he’ll pay the bill at a later date than when he incurs the expense. Biff doesn’t pay Jim for the widgets until July 15 th. Jim completes the work and ships the widgets on June 1 st, and thus earns the revenue on June 1 st. Use the Vendor menu’s Enter Bills command when the moment you incur an expense and the moment you pay the expense are distinct.Įxample: Jim agrees to manufacture and sell Biff a crate of widgets for $1,000. Payables are expenses which a business has incurred, but has not yet paid. Receivables are revenues which a business has earned, but has not yet collected payment on. Two types of accounts exist in accrual basis accounting, but not cash basis accounting: The key differences are summarized in the table below: In order to understand why QuickBooks has several different ways of recording expenses, you’ll need to understand a little bit about cash basis versus accrual basis accounting. But first, we need to start with some background information on cash basis versus accrual basis accounting so this all makes sense. I’ll explain when to use the Enter Bills command versus the Expenses tab on the Write Checks window, how those features are different, and why they exist.

#Entering personal expenses in quickbooks how to#

This short blog post explains how to record your business’ expenses in QuickBooks.

#Entering personal expenses in quickbooks download#

#Entering personal expenses in quickbooks professional#

If the bill is from a lawyer, choose Legal Expense or Professional Fees, depending on what's listed in your chart of accounts. For example, if the bill is from your electric and gas company, choose Utility Expense. Choose an expense account that best represents the nature of the bill.If the invoice contained an invoice reference number, write it in the Ref. Fill in the the amount due and the bill due date. Under date, write the date listed on the bill or invoice.If the bill is from a new vendor, enter the address that the vendor wants the payment sent to.

Review the address to ensure it's correct. If the bill is for an existing vendor, the address field should prepopulate.

0 kommentar(er)

0 kommentar(er)